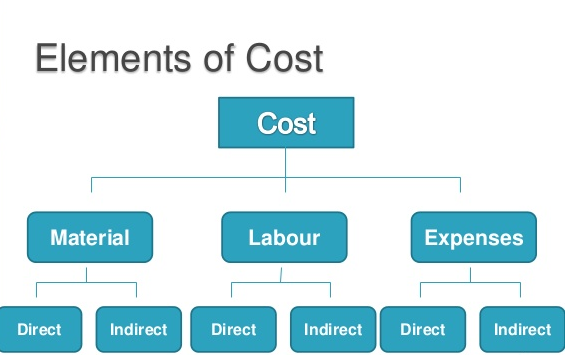

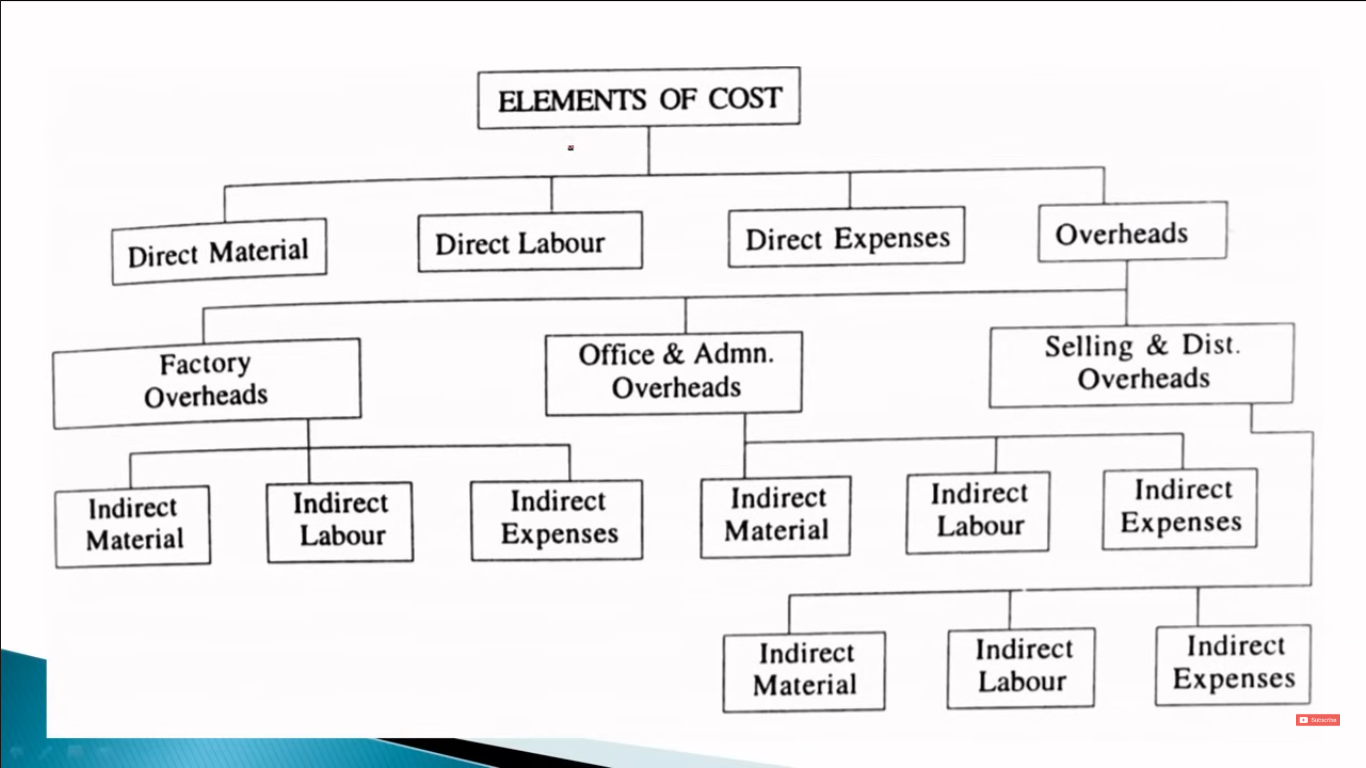

Elements of Cost

Cost accounting classifies costs into three primary categories: Material, Labor, and Expenses.

Material Cost

Material cost represents the cost of all resources used in processing or which aid in the processing of goods. It's incurred to add value to the final product. Materials are tangible resources.

Direct Materials

Direct materials are those that become an integral part of the finished product and can be conveniently traced to it.

- Examples: Wood for furniture, plastic for toys, steel for utensils.

-

Inclusions:

- Materials specifically purchased for a particular product.

- Materials requisitioned from the store.

- Primary packing materials.

Indirect Materials

Indirect materials are necessary for completing the product but are difficult or uneconomical to directly trace to a specific unit of output due to their small consumption or complex usage.

- Examples: Glue used in chair manufacturing, consumable stores, lubricants.

Labor Cost

Labor cost represents the human effort required to convert raw materials into finished goods.

Direct Labor

Direct labor refers to the labor costs of workers directly involved in the production process. These costs can be directly traced to specific end products.

- Examples: Labor of machine operators, assemblers.

Indirect Labor

Indirect labor includes the wages of employees who do not work directly on the product itself but support the manufacturing process. Their efforts are essential but cannot be easily linked to specific products.

- Examples: Production supervisors, factory clerks, maintenance employees.

Expenses

Any cost other than material and labor is classified as an expense.

Direct Expenses

Direct expenses are those, other than material and labor, that can be directly traced to a particular product.

-

Examples:

- Cost of hiring special machines.

- Inward carriage (freight charges on incoming materials).

- Cost of specific molds.

- License fees.

- Experimental costs on models and pilot schemes.

- Royalties.

- Fees paid to architects.

Indirect Expenses

Indirect expenses are all expenditures incurred from the start of production until the finished goods are transferred to the store. These expenses benefit multiple products and are allocated to different products based on appropriate methods.

-

Examples:

- Factory rent.

- Fire insurance.

- Depreciation.

- Power, light, and heat.

- Salaries of storekeepers.

- Factory telephone expenses.

Summary Table

| Cost Element | Type | Description | Examples |

|---|---|---|---|

| Material | Direct | Integral part of the finished product, easily traced. | Wood for furniture, plastic for toys |

| Indirect | Needed for production, difficult to trace. | Glue, lubricants | |

| Labor | Direct | Workers directly involved in production. | Machine operators, assemblers |

| Indirect | Workers supporting the production process. | Supervisors, clerks | |

| Expenses | Direct | Expenses directly linked to a specific product. | Special machine hire, royalties |

| Indirect | Expenses benefiting multiple products, allocated. | Factory rent, depreciation |

Overheads

Overheads encompass all indirect costs, including indirect materials, indirect labor, and indirect expenses. They represent costs that cannot be directly linked to a specific product or service but are necessary for the overall operation of the business.

A manufacturing organization can be broadly divided into three key divisions, each with its own category of overheads:

- Factory or Works: Where the actual production takes place.

- Office and Administration: Where routine and policy decisions are made.

- Selling and Distribution: Where products are sold and delivered to customers.

Types of Overheads

a) Factory Overheads (Manufacturing Overheads)

These overheads are related to the production process within the factory.

-

Indirect Materials: Materials used in the factory that are not directly part of the finished product.

- Examples: Lubricants, oil, consumable stores, cleaning supplies.

-

Indirect Labor: Labor costs of individuals who support the production process but are not directly involved in it.

- Examples: Gatekeeper's salary, timekeeper's salary, works manager's salary, factory supervisor salaries.

-

Indirect Expenses: Expenses related to the factory operations.

- Examples: Factory rent, factory insurance, factory lighting, depreciation of factory equipment, repairs and maintenance.

- Prime Costs = Direct Material + Direct Labour + Direct Expenses

- Prime Cost + Manufacturing Overheads = Works/Factory Cost

- Direct Labour + Direct Expenses+ Manufacturing overheads = Conversion Cost

b) Office and Administration Overheads

These overheads are associated with the general management and administration of the business.

-

Indirect Materials: Materials used in the office.

- Examples: Printing and stationery materials, cleaning supplies for the office.

-

Indirect Labor: Salaries of administrative staff.

- Examples: Office manager's salary, accountant's salary, clerical staff salaries.

-

Indirect Expenses: Expenses related to office operations.

- Examples: Office rent, office insurance, office lighting and heating, depreciation of office equipment, telephone and internet expenses.

c) Selling and Distribution Overheads

These overheads are incurred in the process of selling and distributing the finished goods to customers.

-

Indirect Materials: Materials used in selling and distribution activities.

- Examples: Packing materials, printing and stationery for sales and marketing.

-

Indirect Labor: Salaries and commissions of sales and marketing personnel.

- Examples: Sales manager's salary, salesperson commissions, marketing staff salaries.

-

Indirect Expenses: Expenses related to selling and distribution.

- Examples: Rent for sales offices or warehouses, advertising expenses, transportation costs, delivery expenses, sales promotion expenses.