Option Greeks

Delta,Understanding Gamma,the Rho, Theta, and VegaBasics

OptionImagine Greeksyou've bought an option contract. This contract gives you the right, but not the obligation, to buy (call option) or sell (put option) an asset at a specific price (strike price) by a certain date (expiration date). The price of your option changes based on several factors. The "Greeks" are measureslike ofdials thethat sensitivitytell ofyou anhow sensitive your option's price is to changes in underlyingthose parameters.factors.

Think of it like driving a car:

- The option price is the car's current position.

- The Greeks are the steering wheel, gas pedal, and brakes – they tell you how the car will react to different inputs.

Here are the main Greeks explained simply, with their formulas:

1. Delta (Δ): - The Steering Wheel:

-

Definition:What it tells you:TheHowchangemuch the option price will move for every $1 move in theoption'spricefor a $1 change inof the underlyingasset'sassetprice.(e.g., the stock). -

CalculationExample: If a call option has a delta of 0.60, it means that for every $1 the stock price goes up, the option price will likely go up by $0.60. - Call Options: Delta is always between 0 and 1.

- Put Options: Delta is always between -1 and 0.

-

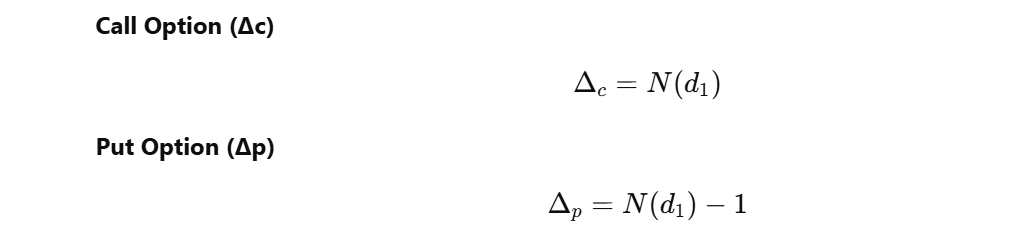

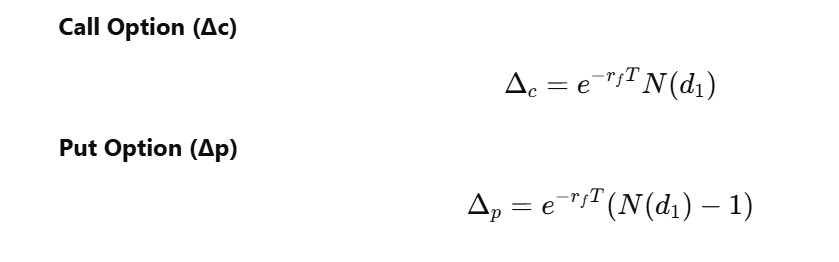

Formula (Stock Option, No Dividend):

Call Option: Δ = N(d1)Put Option: Δ = N(d1) - 1Where N(d1) is the cumulative standard normal distribution function of d1.d1 = [ln(S/K) + (r + (σ^2)/2)T] / (σ√T)

-

CalculationFormula (Stock Option, with Dividend): -

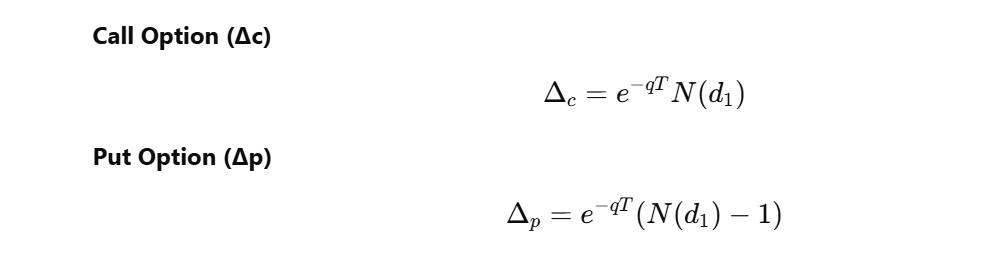

CalculationFormula (Currency Option):Call Option: Δ = e^(-rfT) * N(d1)Put Option: Δ = -e^(-rfT) * N(-d1) Where rf is the foreign risk-free rate.

Where rf is the foreign risk-free rate.

d1 = [ln(S/K) + (rd - rf + (σ^2)/2)T] / (σ√T)Where rd is the domestic risk-free rate, S is the spot exchange rate (domestic/foreign), and K is the strike price.

-

Interpretation:Why it matters:- Delta

CallhelpsDelta:youAunderstandcallhowoption'sexposeddeltayour option isbetweento0 and 1.Put Delta: A put option's delta is between -1 and 0.Currency Option Delta: Depends on the specific currency and rates but represents sensitivity toprice changes in theexchangeunderlyingrate.

2. Gamma (Γ): - The Sensitivity of the Steering Wheel:

-

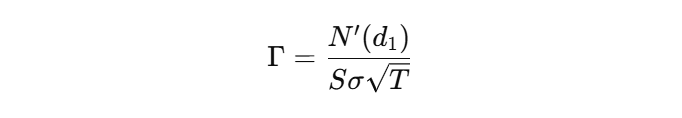

Definition:What it tells you:TheHowratemuchofthe delta will changeof the option's deltaforaevery $1changemove in the underlying asset's price.ItIt'smeasureslike how sensitive thecurvaturesteering wheel is. If Gamma is high, even a small turn of the steering wheel (change in stock price) causes a big change in direction (delta). - Example: If an option has a gamma of 0.10, and the stock price goes up by $1, the delta of the option will increase by 0.10.

- Always Positive (mostly): Gamma is positive for both calls and puts, meaning delta always moves in the same direction as the underlying asset.

-

Formula (Stock and Currency Options):

-

Why it matters: Gamma helps you anticipate how your delta exposure will change as the stock price

withmoves.respectThis is crucial for managing risk, especially when you want to keep your portfolio delta-neutral (explained later).

3. Theta (Θ) - The Time Decay Clock:

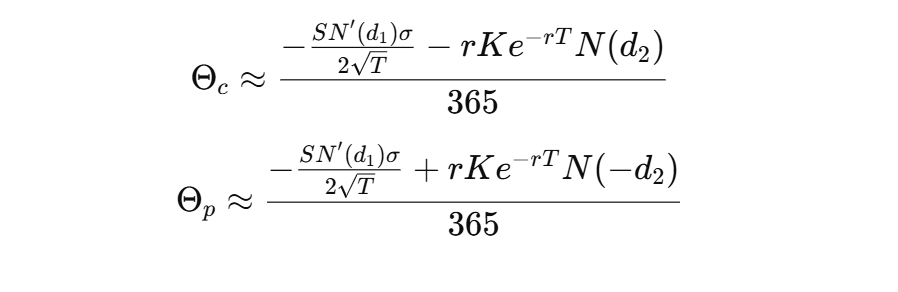

- What it tells you: How much the option price will decrease each day as time passes. Options are "wasting assets" because they lose value as they approach their expiration date.

- Example: If an option has a theta of -0.05, it means the option price will decrease by $0.05 each day, all else being equal.

- Almost Always Negative: Theta is usually negative because options lose value as time goes by.

-

Formula (Stock Option, No Dividend - approximation):

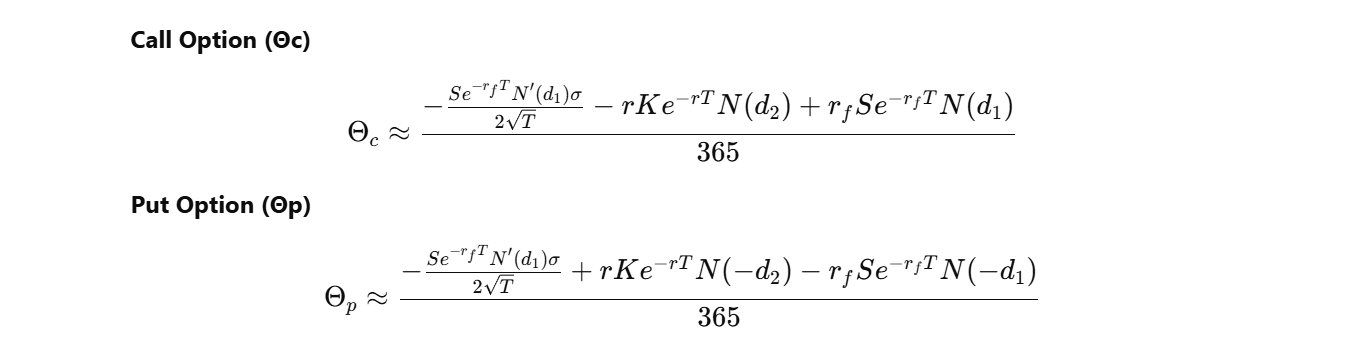

- Formula (Currency Option - approximation):

-

Why it matters: Theta highlights the cost of holding options over time. You need the underlying asset

price.to move in your favor quickly enough to offset the time decay.

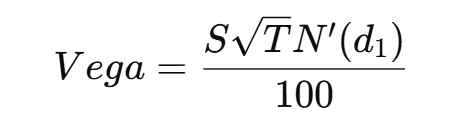

4. Vega (ν) - The Volatility Meter:

- What it tells you: How much the option price will change for every 1% change in the implied volatility of the underlying asset. Implied volatility is a measure of how much the market expects the stock price to fluctuate.

-

CalculationExample: If an option has a vega of 0.20, it means that if implied volatility increases by 1%, the option price will increase by $0.20. - Always Positive: Vega is positive for both calls and puts because higher volatility makes options more valuable (there's a greater chance of a big payout).

- Formula (Stock and Currency Options):

-

Interpretation:Why it matters:GammaVega helps you understand how exposed your option isalways positive for both calls and puts (except for extreme in-the-money or out-of-the-money options where it approaches zero). High gamma means delta is very sensitivetopricechangeschanges.in market uncertainty.

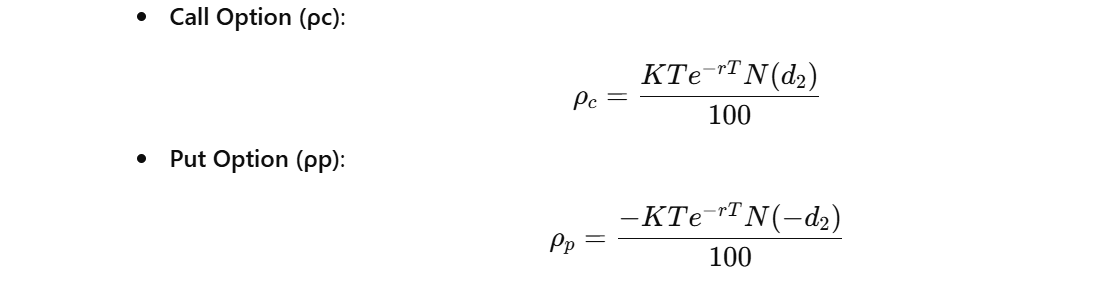

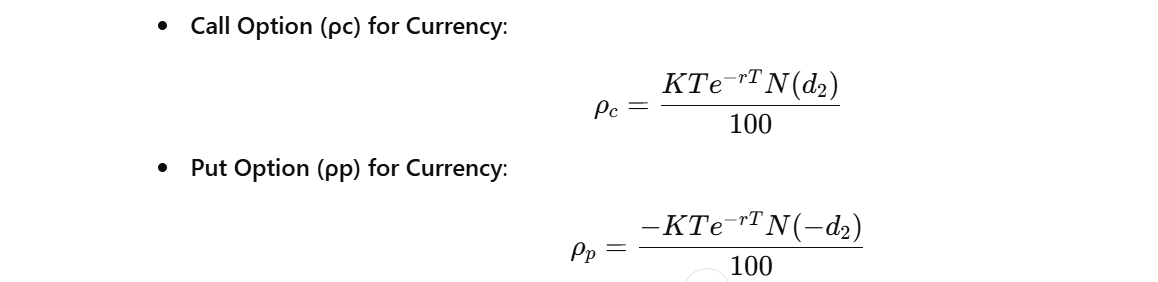

3.5. Rho (ρ): - The Interest Rate Thermometer:

-

Definition:What it tells you:TheHow much the option price will changein the option's priceforaevery 1% change in the risk-free interest rate. -

Calculation (Stock Option, No Dividend):Example:- If

CallaOption:callρoption=hasKTe^(-rT)N(d2)a/rho100of Put0.08,Option:itρmeans=that-KTe^(-rT)N(-d2)if/the100risk-freeWhereinterestd2rate=increasesd1by-1%,σ√Tthe option

-

Calculation (Currency Option):Calls:Call Option: ρ = KTe^(-rdT)N(d2) / 100Put Option: ρ = -KTe^(-rdT)N(-d2) / 100

Interpretation:Calls:Positive Rho (higher interest rates increase call option value).- Puts: Negative Rho (higher interest rates decrease put option value).

4. Theta (Θ):

-

Definition:The change in the option's price for a one-day decrease in time to expiration. Often referred to as "time decay." CalculationFormula (Stock Option, No Dividend):Call Option: Θ = [-SσN'(d1) / (2√T) - rKe^(-rT)N(d2)] / 365Put Option: Θ = [-SσN'(d1) / (2√T) + rKe^(-rT)N(-d2)] / 365

-

CalculationFormula (Currency Option):Call Option: Θ = [-SσN'(d1) / (2√T) + rfKe^(-rdT)N(d2) - rdSe^(-rfT)N(d1)] / 365Put Option: Θ = [-SσN'(d1) / (2√T) - rfKe^(-rdT)N(-d2) + rdSe^(-rfT)N(-d1)] / 365

-

Interpretation:Why it matters:ThetaInterestisrates usuallynegativehave(a smaller impact on short-term optionslose value as time passes),but can bepositivemore significant fordeeplonger-termin-the-money puts.options.

5.Key Vegato (ν):Understanding the Formulas:

-

Definition:S:The change in the option'sCurrent pricefor a 1% change in the volatilityof the underlyingasset.asset (e.g., stock price) -

Calculation (Stock and Currency Options):K:- Strike

νprice=ofS√TtheN'(d1) / 100

-

Interpretation:T:VegaTimeistoalwaysexpirationpositive(expressedforinbothyears) -

andr:puts.Risk-freeOptionsinterestareratemore(expressedvaluableaswhenavolatilitydecimal) -

higher.σ (sigma): Volatility of the underlying asset (expressed as a decimal) - q: Continuous dividend yield (expressed as a decimal)

- r_f: Foreign risk-free rate (expressed as a decimal)

- r_d: Domestic risk-free rate (expressed as a decimal)

- N(x): Cumulative standard normal distribution function (you can use a calculator or spreadsheet to find this value)

- N'(x): Standard normal probability density function (you can use a calculator or spreadsheet to find this value)

-

d1 & d2: Intermediate variables used in the Black-Scholes model:

- d1 = [ln(S/K) + (r + (σ^2)/2) * T] / (σ * √T)

- d2 = d1 - σ * √T

Important Notes:Considerations:

TheseformulasDividends:are based onIf theBlack-Scholesunderlyingmodelstockassumptions.pays Real-worlddividends,optionitpricesaffectsmay deviate from these theoretical values.Dividends and foreign interest rates significantly impactthe option prices andGreeks.the calculations of the Greeks (especially Delta).- Currency Options: Currency options are similar, but instead of a stock, the underlying asset is a currency exchange rate. The formulas are adjusted to take into account the interest rates in both countries.

- The Black-Scholes Model is a Simplification: The Black-Scholes model makes certain assumptions that may not always hold true in the real world. Therefore, the calculated Greeks are just estimates, not guarantees. The formulas marked with "approximation" are simplified versions for illustrative purposes. More precise calculations may be required in practice.

In summary: The Greeks are essential tools for understanding and managing the risks associated with options trading. They help you quantify how sensitive your option positions are to various market factors. The formulas provide a more precise way to calculate these sensitivities.