Leasing

Leasing Concepts

-

Core Idea: Leasing is a contractual agreement granting the right to use an asset for a specified period in exchange for periodic payments (rentals). It's an alternative to outright purchase.

-

Key Players:

- Lessor: The owner of the asset who grants the right to use it.

- Lessee: The party who obtains the right to use the asset.

-

Legal Nature: A lease is a legally binding contract outlining rights, obligations, and responsibilities of both lessor and lessee. Failure to comply with terms has legal consequences.

-

Economic Substance: Leasing is a form of asset financing. The lessee gains access to an asset without a large initial investment. The lessor receives a return on their investment via rental payments.

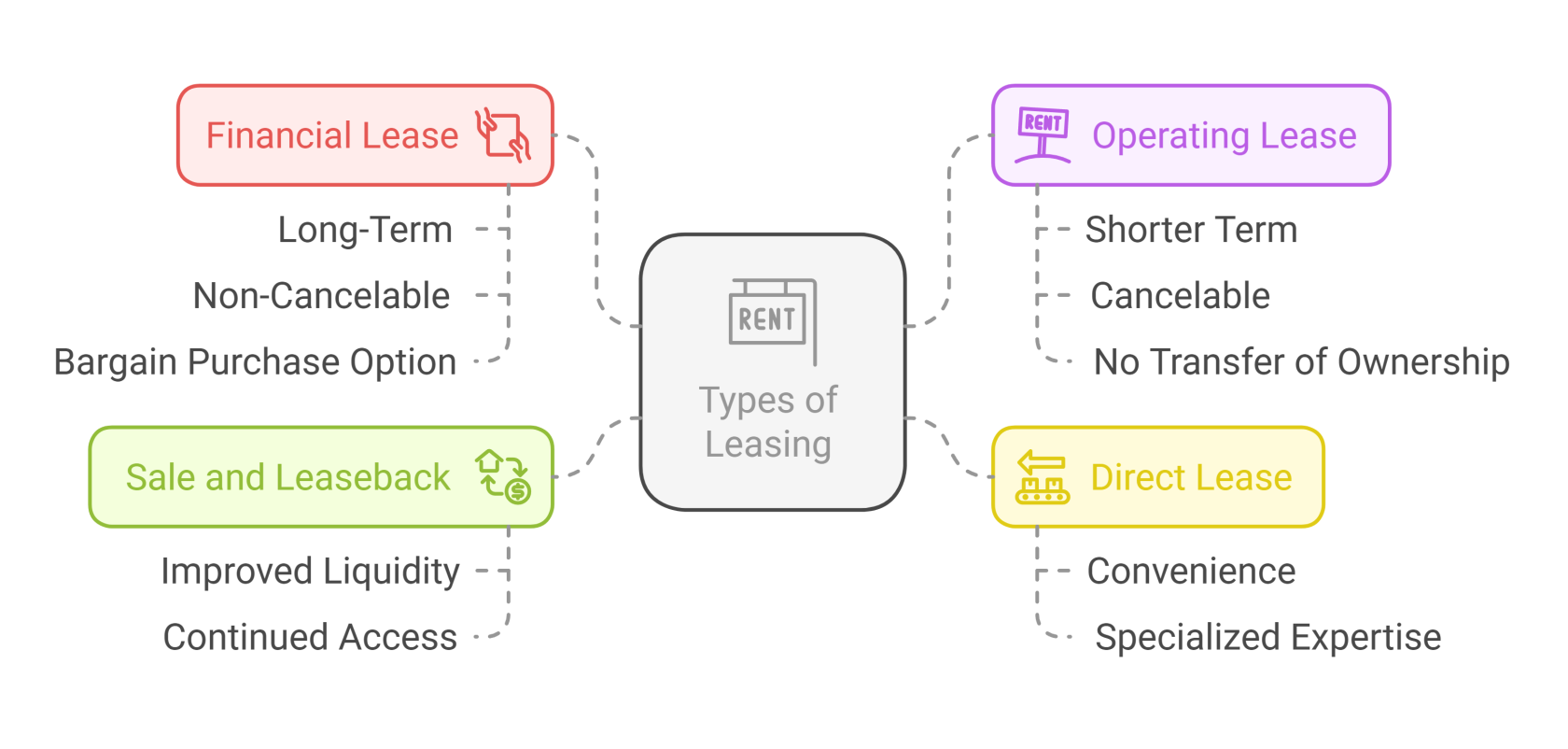

Types of Leasing

-

Financial Lease (Capital Lease):

- Characterized by: A substantial transfer of risks and rewards of ownership to the lessee, without legal title passing.

-

Features:

- Long-Term: Lease term covers a significant portion of the asset's economic life.

- Non-Cancelable (or Heavily Penalized): Difficult or costly to terminate early.

- Bargain Purchase Option: Lessee has the option to purchase the asset at a price significantly below fair market value at the end of the lease.

- Asset-Specific: Often tailored to the lessee's particular needs.

- Lessee Responsibilities: Bear maintenance, insurance, and other operating costs.

- Accounting Treatment: Lessee recognizes the leased asset and lease obligation as assets and liabilities on their balance sheet. Depreciation expense and interest expense are recognized on the income statement.

-

Why choose a Financial Lease?

- Access to an asset without a large initial capital outlay.

- Potential tax benefits (depending on jurisdiction).

- Asset availability for a substantial portion of its useful life.

-

Operating Lease:

- Characterized by: The lessor retaining most of the risks and rewards of ownership. A true "rental" agreement.

-

Features:

- Shorter Term: Lease term is shorter than the asset's economic life.

- Cancelable: Easier to terminate (often with reasonable notice).

- No Transfer of Ownership: Ownership remains with the lessor.

- Lessor Responsibilities: Typically responsible for maintenance, insurance, and other operating costs.

- Accounting Treatment: Lessee does not recognize the asset or liability on their balance sheet. Lease payments are treated as rental expense on the income statement. (Note: Accounting standards are changing in many jurisdictions, requiring recognition of operating leases on the balance sheet for leases beyond a certain duration).

-

Why choose an Operating Lease?

- Access to an asset for a limited time.

- Flexibility to upgrade to newer equipment more easily.

- Avoidance of obsolescence risk.

- Off-balance-sheet financing (though less prevalent now with evolving accounting standards).

-

Direct Lease:

- Definition: A lease arrangement where the manufacturer or vendor of the asset leases the asset directly to the lessee. There's no intermediary leasing company.

- Example: A construction equipment manufacturer leases its own equipment to a construction company.

-

Benefits:

- Can be convenient for the lessee.

- May offer specialized expertise related to the specific asset.

- The manufacturer has more control over the use and maintenance of its equipment.

-

Sale and Leaseback:

- Process: A company sells an asset it already owns to a leasing company, and then leases it back from the leasing company.

- Purpose:

- Freeing Up Capital: Generates immediate cash from the sale of the asset.

- Maintaining Use: The company retains the use of the asset for its operations.

-

Benefits:

- Improved liquidity.

- Continued access to the asset.

- Potential tax advantages.

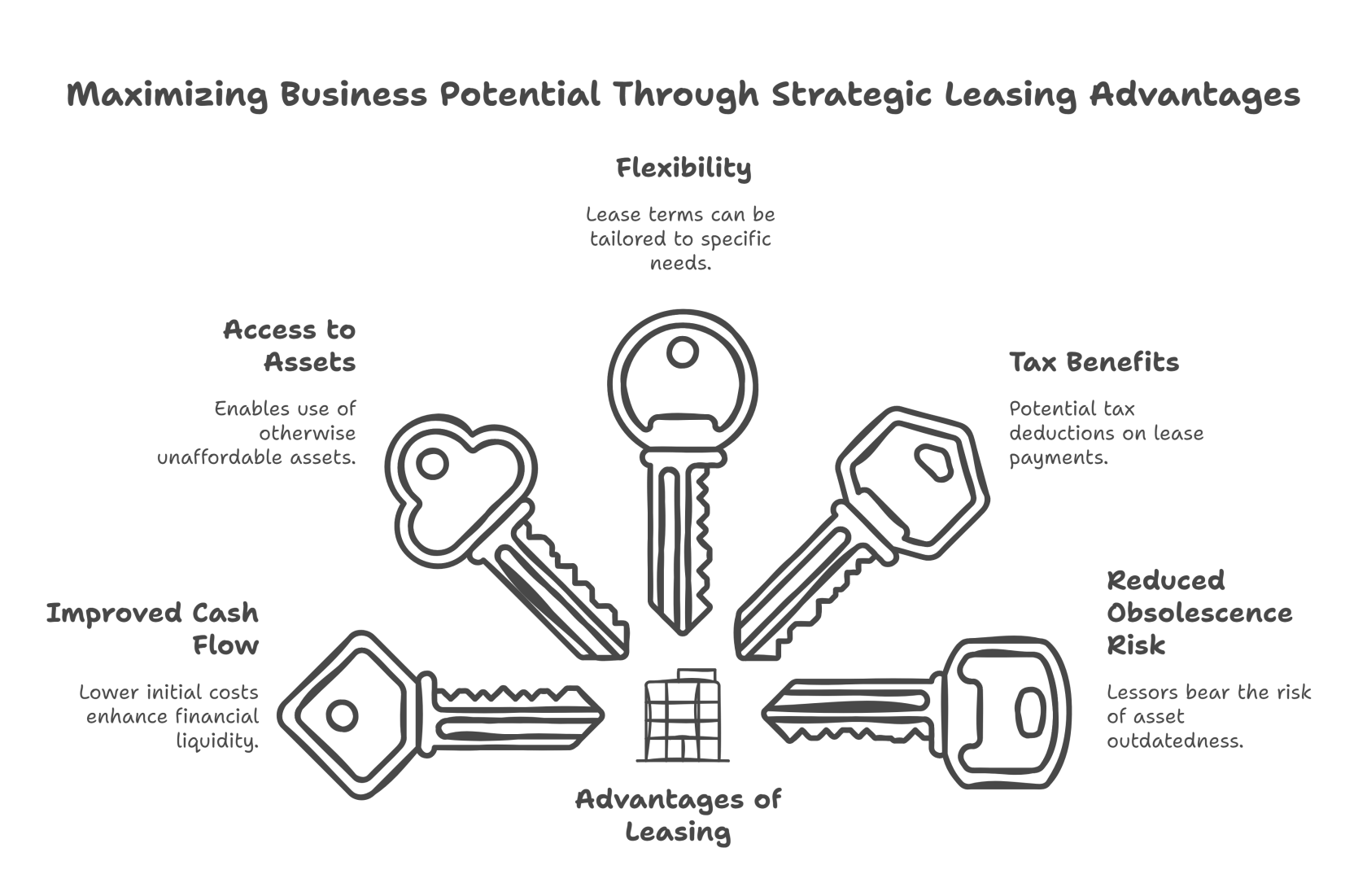

Advantages of Leasing

- Improved Cash Flow: Lower initial outlay compared to purchasing.

- Access to Assets: Enables companies to use assets they might not otherwise afford.

- Flexibility: Lease terms can sometimes be tailored to specific needs.

- Tax Benefits: Lease payments may be tax-deductible. (Consult with a tax advisor).

- Reduced Obsolescence Risk: Particularly relevant for operating leases, where the lessor bears the risk of the asset becoming outdated.

- Simplified Accounting: Can simplify accounting procedures (though increasingly less so with changes in lease accounting standards).

- Convenience: Easier process than obtaining traditional financing.

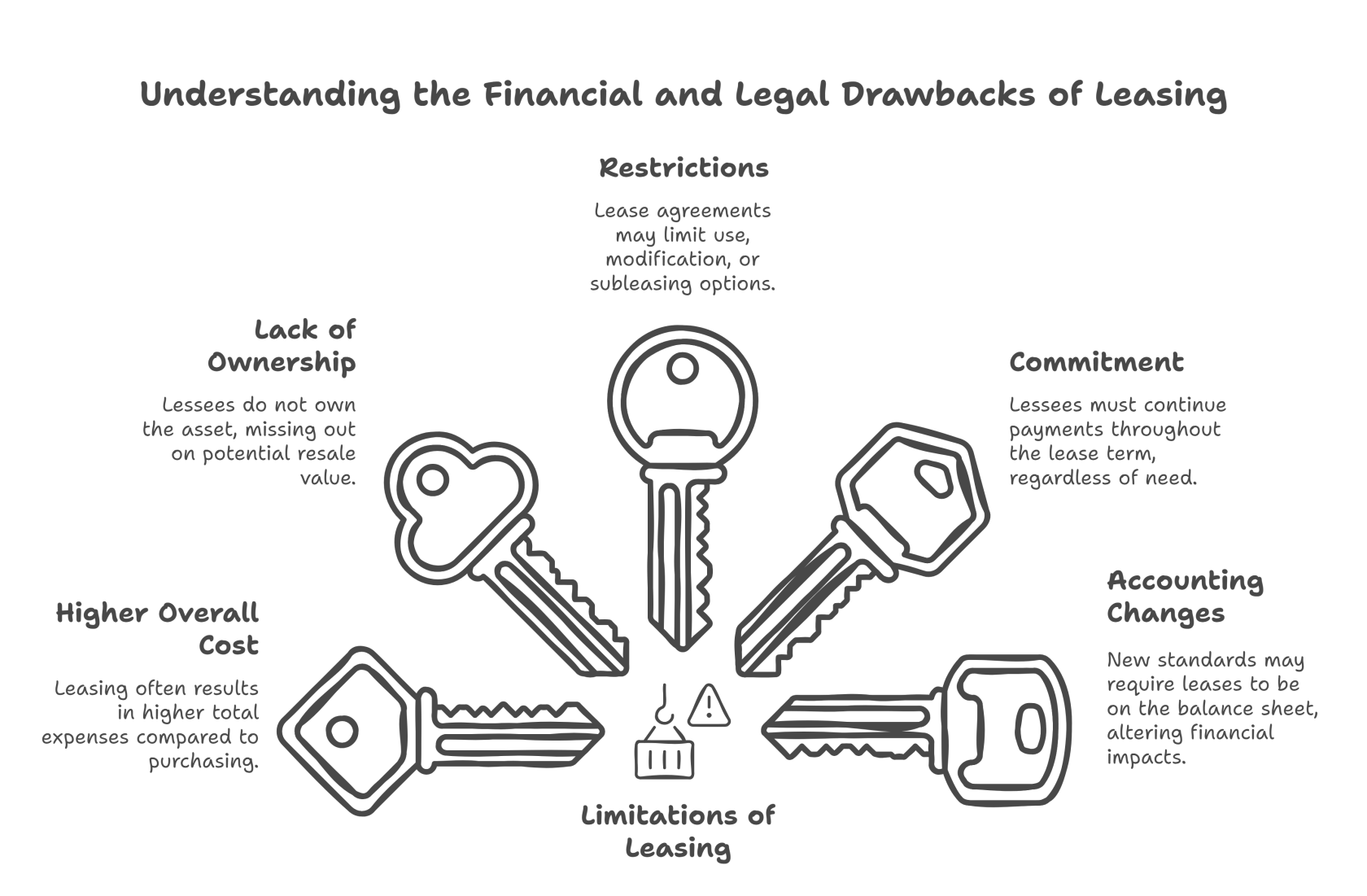

Limitations of Leasing

- Higher Overall Cost: Leasing is generally more expensive than purchasing in the long run.

- Lack of Ownership: You never own the asset, limiting potential resale value.

- Restrictions: Lease agreements can impose restrictions on the use, modification, or subleasing of the asset.

- Commitment: You're obligated to make lease payments for the duration of the lease, even if you no longer need the asset.

- Accounting Changes: Evolving accounting standards may require leases to be recognized on the balance sheet, negating previous off-balance-sheet financing benefits.

-

Potential Legal Issues: In case of the Lessor goes bankrupt.

No Comments