Introduction to Indian Accounting Standards

What are Ind AS?

-

Global Standards, Indian Twist: Ind AS are accounting rules used in India that are based on international accounting standards (called IFRS - International Financial Reporting Standards). Think of it like taking a globally accepted recipe and slightly adjusting it for Indian tastes.

-

Developed in India: These standards aren't just copied; they're created in India by the:

- Accounting Standards Board (ASB) of the ICAI: The main group responsible for making the rules. The Institute of Chartered Accountants of India (ICAI) is a professional accounting body in India.

- Consultation with NFRA: The ASB works with the National Financial Reporting Authority (NFRA) to make sure everything's done correctly.

-

Mandatory for Some: Ind AS are not optional for all companies. They are mandatory for certain Indian companies, typically the larger ones, to ensure they follow globally accepted accounting practices.

-

Aim for Global Alignment: Ind AS are designed to make Indian companies' financial reports understandable and comparable with those of companies in other parts of the world.

Why do they exist?

- Global Compatibility: To make it easier for investors and other stakeholders to understand and compare the financial health of Indian companies with companies globally.

- Transparency and Reliability: To ensure that financial reports are accurate, reliable, and transparent, leading to more trust.

Who is in charge?

- The Accounting Standards Board (ASB): This group, established in 1977, is the main body responsible for creating and implementing Ind AS. They decide the rules and make sure companies follow them.

IND-AS 1: Presentation of Financial Statements

What is IND-AS 1 about?

IND-AS 1 is like the first chapter in a financial reporting textbook. It doesn't tell you how to do the math; instead, it focuses on how the results should be presented. It’s about setting the rules for how a company’s financial reports should be structured and what information they must include. It aims to make financial statements:

- Understandable: Easy to read and grasp for people who need to use them.

- Comparable: Easy to compare with other companies' financial reports (and with a company's own reports over time).

- Consistent: Following a consistent set of rules so that information is presented the same way year after year.

Key Things IND-AS 1 covers:

-

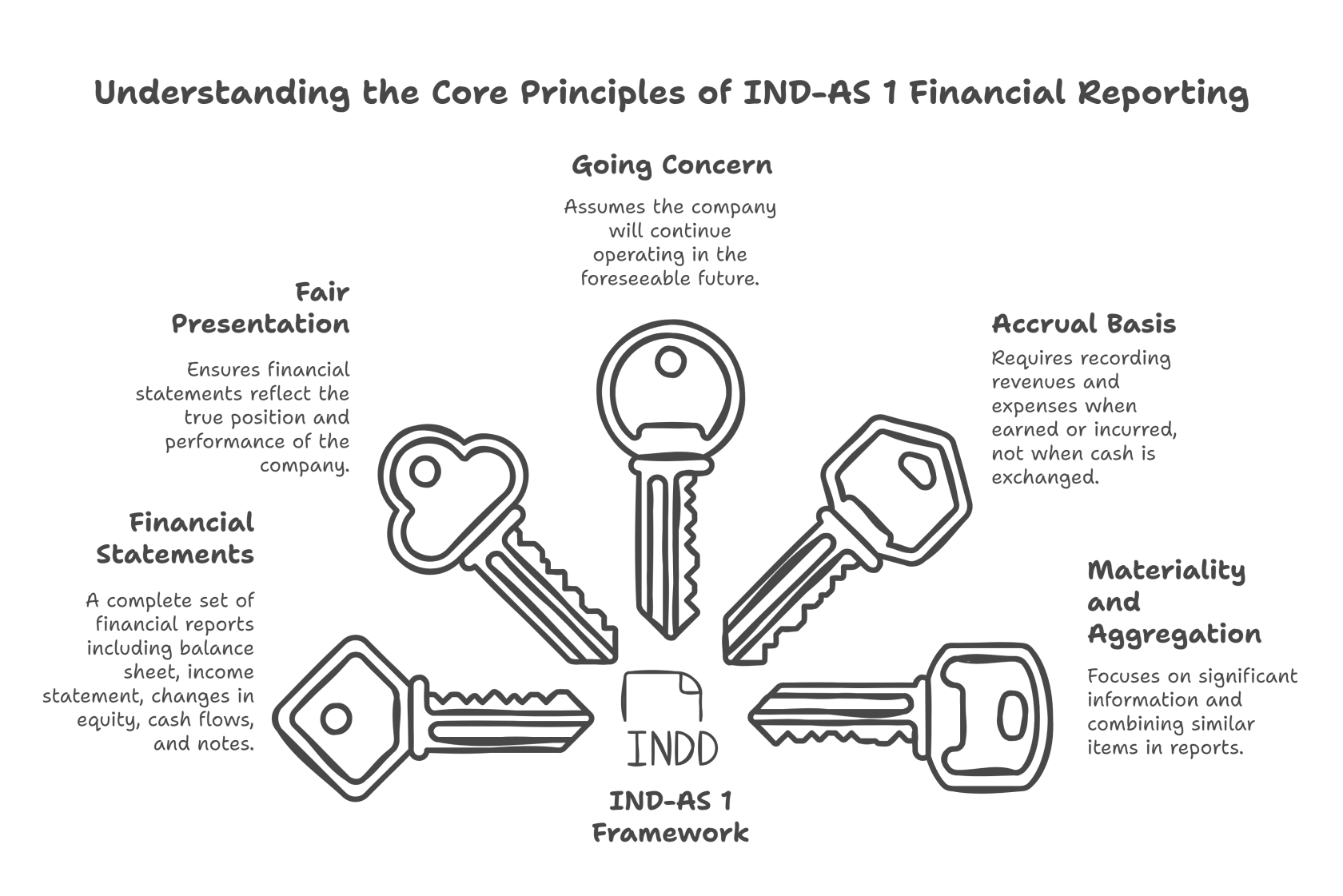

What is in a complete set of Financial Statements?

- It's like a standard package of financial reports that every company should present. It includes:

- Balance Sheet: A snapshot of what the company owns (assets), owes (liabilities), and the owners' stake (equity) at a specific point in time.

- Statement of Profit and Loss (Income Statement): Shows how much money the company made (revenue), spent (expenses), and its profit or loss over a specific period.

- Statement of Changes in Equity: Explains how the owners' stake in the company changed over a period.

- Statement of Cash Flows: Tracks the flow of cash in and out of the company, categorizing them into operating, investing, and financing activities.

- Notes to the Accounts: Provides additional information, like an explanation of the company's accounting policies and details of specific numbers in the other reports.

- It's like a standard package of financial reports that every company should present. It includes:

-

Fair Presentation:

- Companies must present their financial statements fairly, which means they should reflect the true financial position and performance of the company, not misrepresent it.

- It is like making sure you are representing your grades fairly and honestly.

-

Going Concern:

- Financial statements are generally prepared assuming that the company will continue to operate in the foreseeable future. This is the going concern concept.

- It is like assuming a train will continue on its track unless there is a reason to think it won't.

-

Accrual Basis of Accounting:

- Companies must record revenues when they are earned and expenses when they are incurred, regardless of when cash is received or paid.

- It’s like recognizing the income when you have sold something, even if you are not paid until later.

-

Materiality and Aggregation:

- Companies don't need to present every little detail; they should only focus on information that is considered "material," meaning significant enough to affect the decisions of those using the reports.

- They should also combine similar items rather than giving each a separate line item.

- It's like focusing on the main points of a story instead of the minute details.

-

Consistency:

- Companies should apply the same accounting policies from one period to the next to ensure their financial statements can be compared over time.

- It's like consistently using the same measuring tape to track changes over time.

-

Comparative Information:

- Financial statements should include comparative figures from the previous year, allowing for comparison of the company's performance over time.

- It's like showing your current progress in comparison with last year’s performance.

Why is IND-AS 1 important?

- Clarity: It ensures that financial reports are clear and understandable.

- Comparison: It enables easy comparison of one company’s financials to another and to past performance.

- Trust: It increases confidence in financial reports.

- Standard Format: It provides a standard way of presenting financials, which makes things easier for everyone.

No Comments