Cryptocurrency Futures Contract Specifications

Standardizing Derivatives

This topic outlines the typical specifications for futures contracts based on the cryptocurrencies we've discussed. Note that contract specifications can vary slightly between exchanges (e.g., CME, Binance, FTX (now defunct)), so always refer to the specific exchange's documentation for the most accurate details.

General Concepts:

- Futures Contract: An agreement to buy or sell a specific asset (in this case, cryptocurrency) at a predetermined price on a future date.

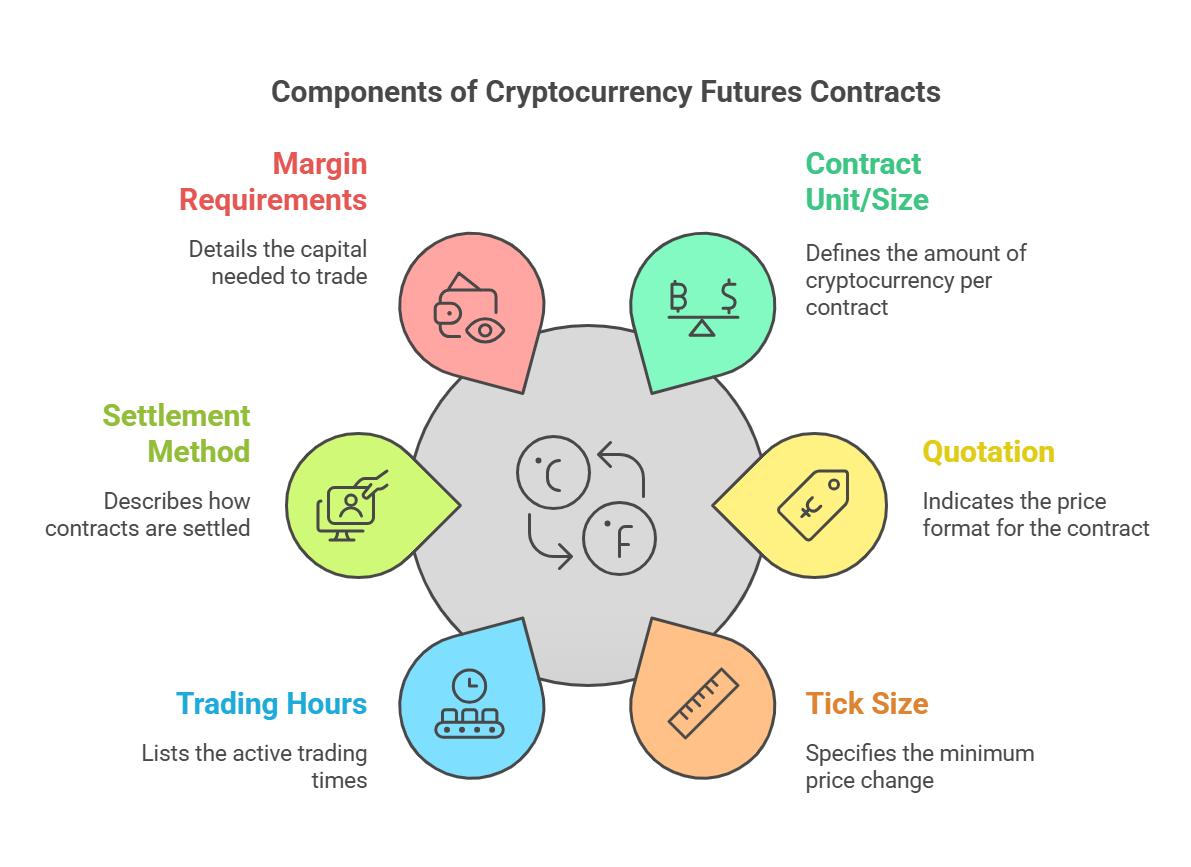

- Contract Unit/Size: The amount of cryptocurrency represented by one futures contract.

- Quotation: How the price of the futures contract is quoted (e.g., USD per Bitcoin).

- Minimum Price Fluctuation (Tick Size): The smallest increment by which the price of the contract can change.

- Trading Hours: The hours during which the contract can be traded.

-

Settlement Method: How the contract is settled at expiration (cash-settled or physically delivered).

- Cash-Settled: The contract is settled in cash, based on the difference between the final settlement price and the original contract price.

- Physically Delivered: The underlying cryptocurrency is delivered to the buyer at expiration.

- Last Trading Day: The last day on which the contract can be traded.

- Settlement Day: The day on which the contract is settled.

- Margin Requirements: The amount of capital required to open and maintain a position in the futures contract.

- Position Limits: The maximum number of contracts that a trader can hold.

Typical Futures Contract Specifications (Examples):

It's impossible to give exact specifications as these change and vary across exchanges. However, the following provides a general overview. Be sure to consult the specific exchange's documentation.

| Feature | Bitcoin (BTC) Futures (e.g., CME) | Ethereum (ETH) Futures (e.g., CME) | [Hypothetical] Altcoin Futures (e.g., on a crypto exchange) |

|---|---|---|---|

| Underlying Asset | Bitcoin | Ethereum | The specific altcoin (e.g., EOS, LTC, BCH, XRP) |

| Contract Unit | 5 BTC | 50 ETH | Varies significantly, e.g., 100 EOS, 1000 LTC |

| Quotation | USD per Bitcoin | USD per Ethereum | USD per [Altcoin] |

| Tick Size | $5 per BTC ($25 per contract) | $0.25 per ETH ($12.50 per contract) | Varies, e.g., $0.0001 per [Altcoin] |

| Trading Hours | 6:00 PM - 5:00 PM ET Sunday - Friday | 6:00 PM - 5:00 PM ET Sunday - Friday | 24/7 (typical for crypto exchanges) |

| Settlement Method | Cash-Settled | Cash-Settled | Cash-Settled (most common) or Physically Delivered |

| Settlement Price | Volume-Weighted Average Price (VWAP) Index | Volume-Weighted Average Price (VWAP) Index | Varies, often based on a spot price index |

| Contract Months | Monthly | Monthly | Often quarterly or perpetual |

| Last Trading Day | Last Friday of the contract month | Last Friday of the contract month | Varies, depends on the exchange |

- Exchange Variations: Contract specifications can differ significantly between exchanges. Always consult the specific exchange's documentation for the most up-to-date and accurate information.

- Regulatory Changes: The regulatory landscape for cryptocurrency futures is constantly evolving, which can impact contract specifications.

- Liquidity: Liquidity can vary significantly between different cryptocurrency futures contracts. More liquid contracts (e.g., BTC, ETH) typically have tighter bid-ask spreads and lower transaction costs.

- Altcoin Futures: Specifications for altcoin futures (LTC, BCH, XRP, EOS) are less standardized and can vary widely. Many crypto exchanges offer "perpetual swaps" (a type of futures contract with no expiration date) on these coins.

No Comments