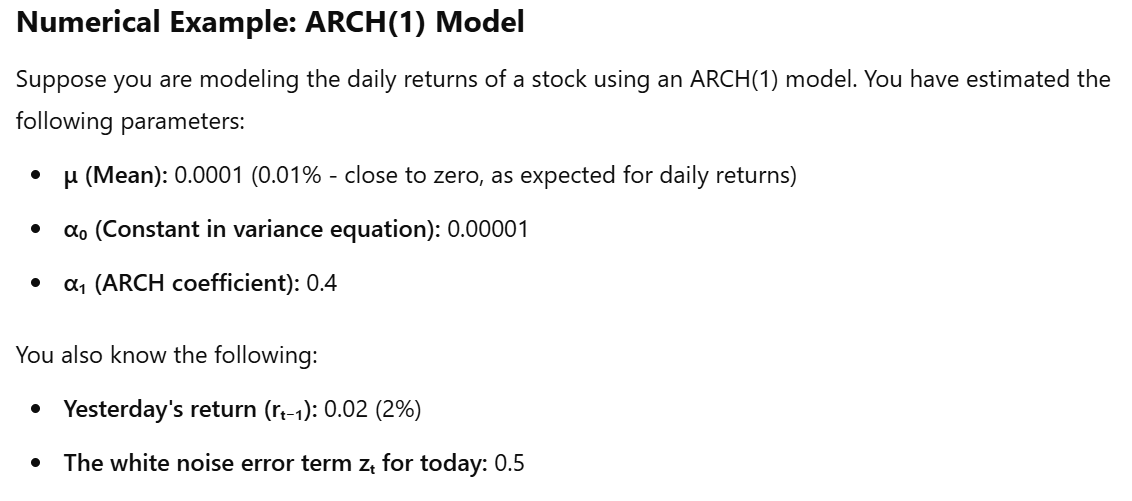

Numerical Example

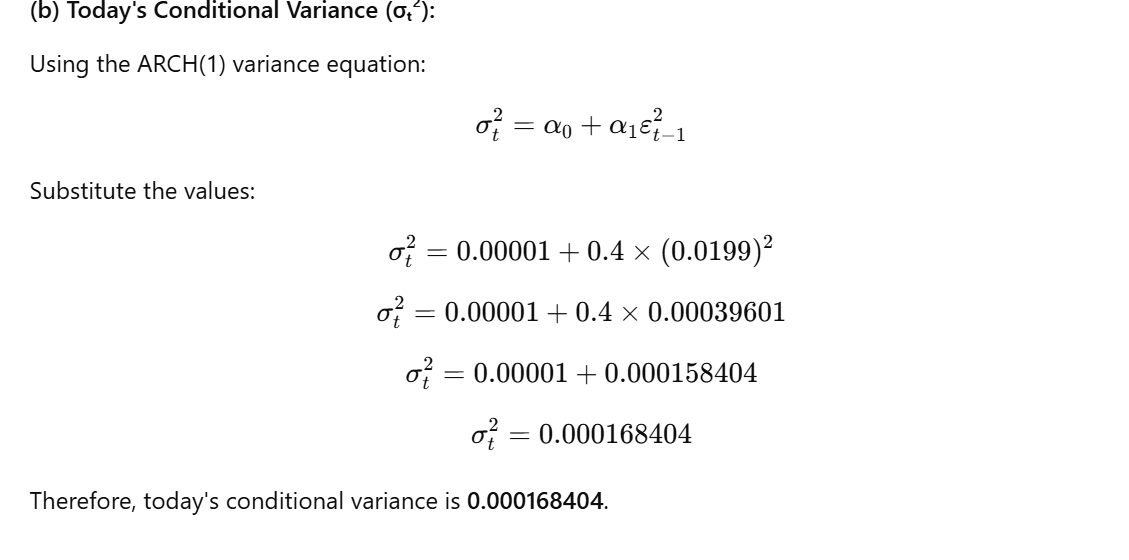

Comparison:

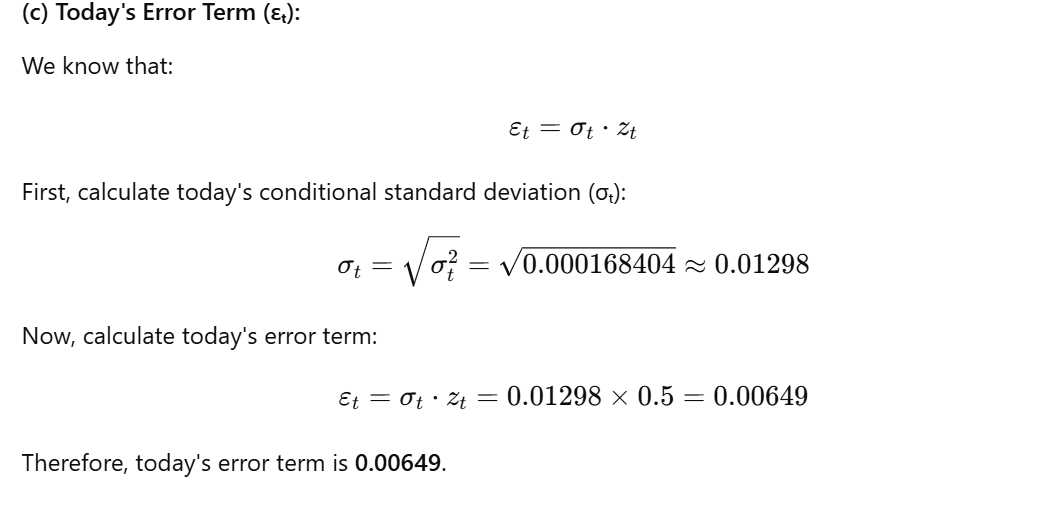

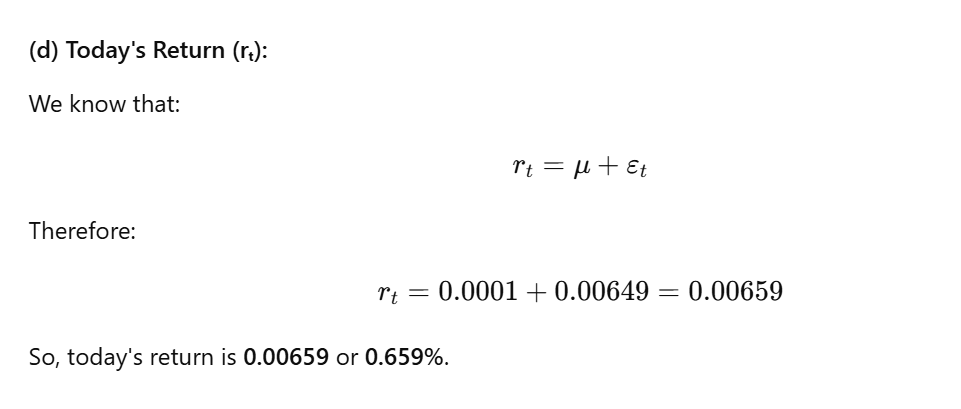

- With a positive return yesterday (2%), today's conditional variance was 0.000168404.

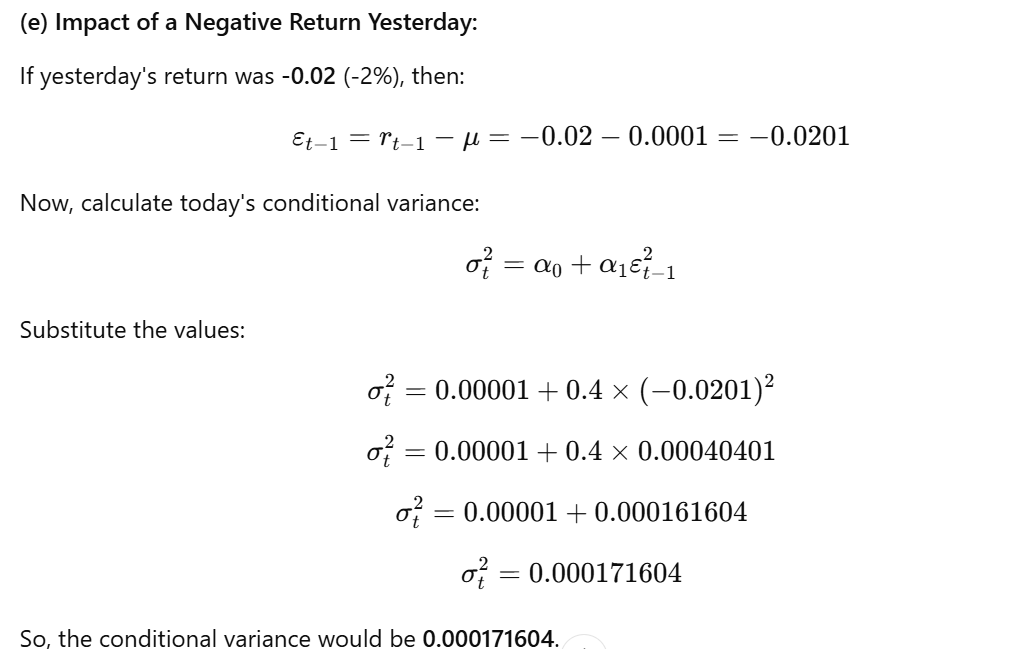

- With a negative return yesterday (-2%), today's conditional variance is 0.000171604.

Key Observation:

The ARCH(1) model responds symmetrically to positive and negative shocks. A larger magnitude shock yesterday (regardless of sign) leads to a higher conditional variance today. This is a key limitation of the ARCH model, as it does not capture the leverage effect (where negative shocks tend to have a greater impact on volatility than positive shocks).

In Summary:

This example illustrates how the ARCH(1) model updates the conditional variance based on past squared errors. The parameters of the model (μ, α₀, α₁) determine the level of volatility and the sensitivity of volatility to past shocks.

No Comments