Insuring Life

Benefits of Life Insurance

Life insurance serves as a financial safety net, ensuring that dependents and loved ones remain financially secure in case of the policyholder's untimely demise. Here are some of the key benefits:

- Financial Security: Provides financial support to family members, replacing the income lost due to the policyholder's death.

- Debt Protection: Ensures that outstanding loans and liabilities (such as home loans, car loans, or personal loans) do not burden the dependents.

- Tax Benefits: Premiums paid for life insurance policies are eligible for tax deductions under Section 80C of the Income Tax Act, reducing taxable income.

- Savings & Investment: Certain policies, such as endowment plans and Unit Linked Insurance Plans (ULIPs), combine protection with investment benefits.

- Estate Planning: Whole life insurance policies help in wealth transfer by ensuring that assets are passed on to heirs without legal complications.

- Peace of Mind: Offers reassurance to policyholders that their loved ones will be financially taken care of in their absence.

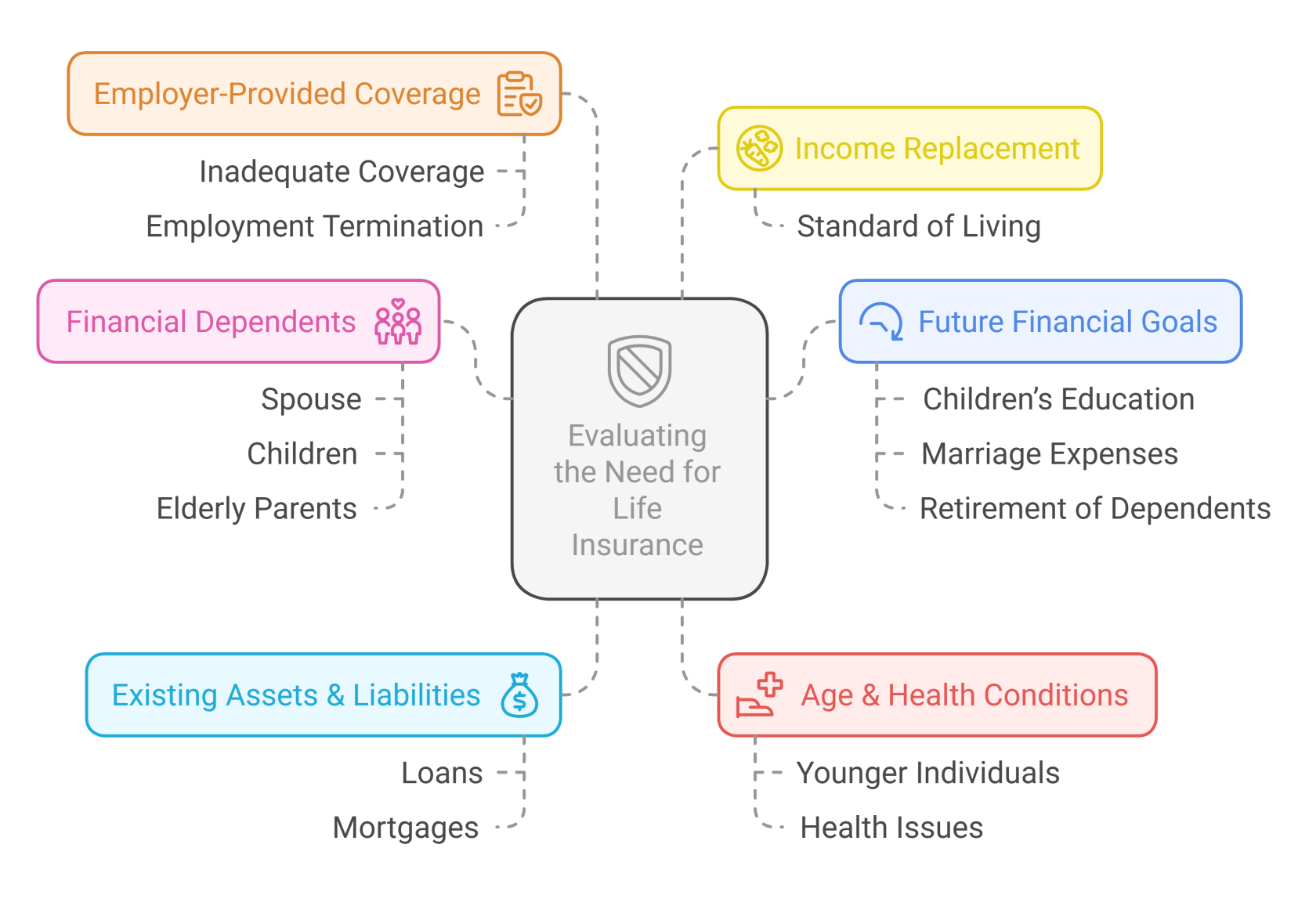

Evaluating the Need for Life Insurance

Determining whether an individual needs life insurance depends on several factors. The following considerations help assess the necessity of life insurance:

- Financial Dependents: If an individual has a spouse, children, elderly parents, or others relying on their income, life insurance is essential.

- Existing Assets & Liabilities: Individuals with significant loans or mortgages should consider insurance to cover outstanding debts in case of an unforeseen event.

- Income Replacement: Life insurance ensures that a family’s standard of living is maintained even if the primary earner is no longer there.

- Future Financial Goals: Policies can be tailored to fund children’s education, marriage expenses, or retirement of dependents.

- Age & Health Conditions: Younger individuals can obtain life insurance at lower premium rates, while those with health issues may face higher premiums or limited policy options.

- Employer-Provided Coverage: While many employers offer group insurance, it is often inadequate and ceases once employment ends, necessitating individual coverage.

Determining the Right Amount of Life Insurance

Selecting the appropriate sum assured (insurance coverage amount) is crucial. The right amount varies based on individual financial needs and obligations. There are three primary methods for calculating the required life insurance coverage:

1. Human Life Value (HLV) Method

This method estimates the present value of future income that the policyholder would have contributed to their dependents over their working lifetime.

- Formula: [ HLV = Annual Income Available for Family \times Number of Years Until Retirement ]

- Example:

- Annual income: Rs. 5,00,000

- Expenses on self-maintenance & taxes: Rs. 80,000

- Amount available for family: Rs. 4,20,000

- Remaining working years: 30

- Discount Rate: 8%

- Required insurance coverage: Rs. 51,06,530 (present value of income for 30 years)

2. Need-Based Method

This approach calculates the sum assured based on future financial requirements, such as:

- Emergency fund

- Education fund

- Children’s marriage fund

- Retirement fund

- Mortgage repayment fund

The total present value of these needs is calculated, and existing savings and investments are deducted to determine the necessary coverage.

3. Multiple Approach Method

This method considers the income replacement requirement based on an expected rate of return from investments.

- Formula: [ Insurance Required = Annual Family Income Requirement / Expected Rate of Return ]

- Example:

- Required family income: Rs. 2,40,000 per year

- Expected investment return: 10%

- Required insurance coverage: Rs. 24,00,000

Case Study: Mr. Grover's Insurance Requirement

Mr. Grover, a 30-year-old individual, earns Rs. 5,00,000 annually (net of taxes). His expenses include:

- Self-maintenance: Rs. 40,000

- Medical insurance premium: Rs. 15,000

- Taxes and other expenses: Rs. 25,000

Amount available for family = Rs. 5,00,000 - Rs. 80,000 = Rs. 4,20,000

- He plans to work until retirement at 60 (remaining 30 years).

- Using an 8% discount rate, his required insurance cover is Rs. 51,06,530.

- If he already has Rs. 10 lakh in investments and Rs. 10 lakh in term insurance, his additional required coverage is Rs. 31 lakh.

By using these methods, individuals can ensure that they select the right life insurance coverage to protect their family’s financial future.

No Comments