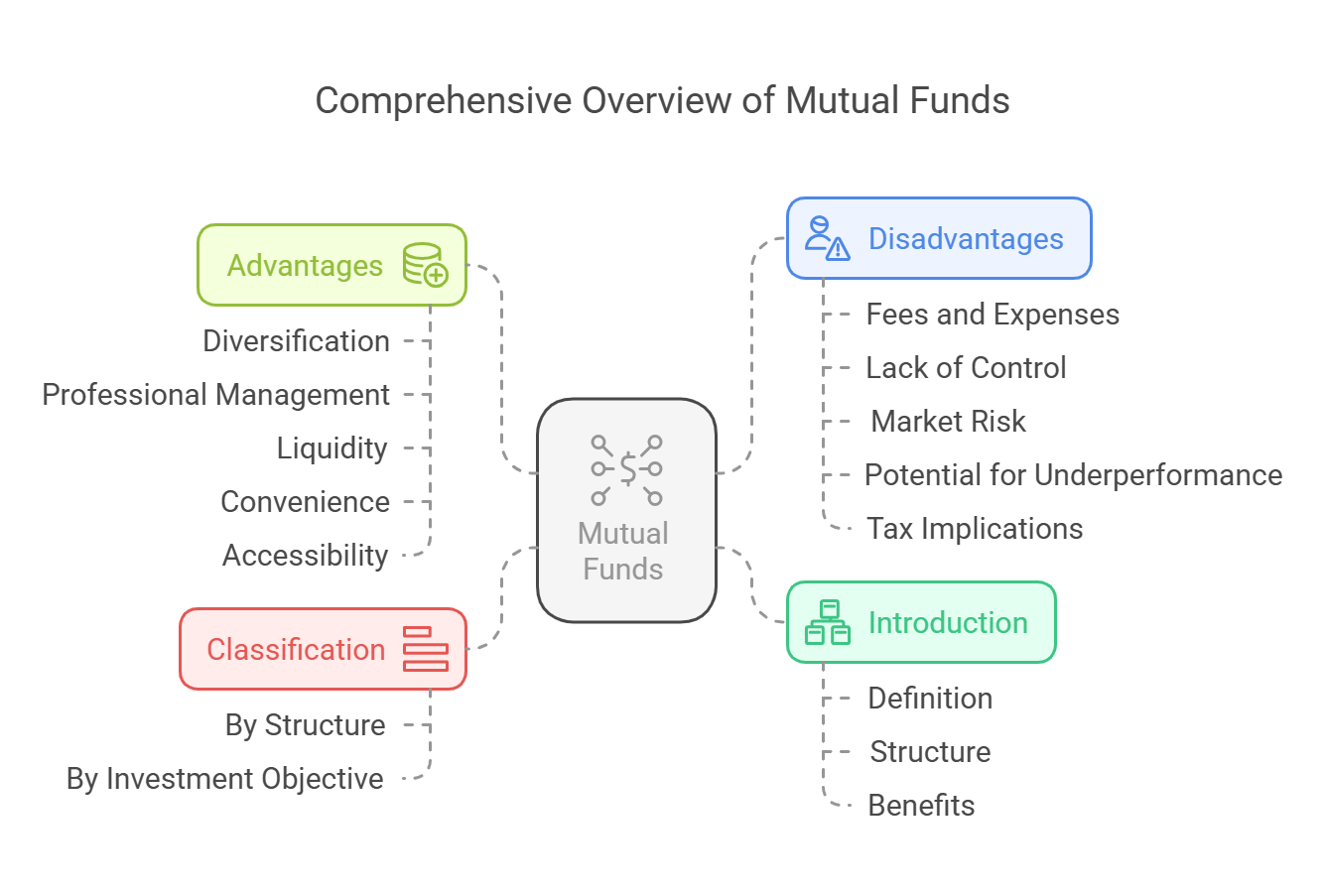

Mutual Funds

Introduction, Classification, Advantages, and Disadvantages

Core Concept: Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, or other assets. They offer individual investors access to professional portfolio management, diversification, and economies of scale.

1. Introduction to Mutual Funds

- Definition: A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities.

-

Structure:

- The fund is managed by a fund manager or a team of fund managers.

- Investors purchase shares or units of the fund.

- The fund's net asset value (NAV) per share is calculated daily by dividing the total value of the fund's assets (less liabilities) by the number of outstanding shares.

- Mutual funds are regulated by government agencies to protect investors.

-

Benefits for Investors:

- Diversification: Access to a diversified portfolio of securities, which reduces risk.

- Professional Management: Expertise of professional fund managers who make investment decisions.

- Liquidity: Shares can typically be bought and sold on any business day.

- Convenience: Simplified investment process with easy access and management.

- Accessibility: Lower minimum investment amounts compared to direct investment in individual securities.

2. Classification of Mutual Fund Schemes

Mutual fund schemes can be classified based on various criteria:

A. Classification by Structure:

-

1. Open-Ended Funds:

- Characteristics: Continuously offer new shares to investors and redeem existing shares.

- Size: The size of the fund can vary depending on investor demand.

- Liquidity: Highly liquid, as investors can buy and sell shares on any business day at the fund's NAV.

- Example: Most equity funds, debt funds, and balanced funds are open-ended.

-

2. Closed-Ended Funds:

- Characteristics: Offer a fixed number of shares at the time of initial public offering (IPO).

- Trading: Shares are subsequently traded on a stock exchange.

- Liquidity: Less liquid than open-ended funds, as investors can only buy or sell shares on the secondary market.

- Price: The market price of the shares may differ from the fund's NAV.

- Example: Some income funds and real estate funds are closed-ended.

- 3. Interval Funds: * Characteristics: Hybrid between open-ended and closed-ended funds. These funds allow investors to purchase or redeem shares only at predetermined intervals, such as monthly, quarterly, or annually. * Liquidity: Less liquid than open-ended funds, but more liquid than close-ended funds. * Price: Shares are usually bought and sold at NAV. * Example: Real estate funds and private equity funds.

B. Classification by Investment Objective:

-

1. Equity Funds:

- Investment Focus: Primarily invest in stocks or equities of companies.

- Objective: Capital appreciation and long-term growth.

- Risk Level: Generally higher risk than other types of funds.

-

Types of Equity Funds:

- Large-Cap Funds: Invest in stocks of large companies with stable growth.

- Mid-Cap Funds: Invest in stocks of mid-sized companies with higher growth potential.

- Small-Cap Funds: Invest in stocks of small companies with the highest growth potential but also higher risk.

- Sector Funds: Invest in stocks of companies in a specific sector, such as technology, healthcare, or energy.

- Thematic Funds: Invest in companies based on a specific theme, such as infrastructure, consumption, or digitalization.

-

2. Debt Funds:

- Investment Focus: Primarily invest in fixed-income securities, such as bonds, debentures, and government securities.

- Objective: Income generation and capital preservation.

- Risk Level: Generally lower risk than equity funds.

-

Types of Debt Funds:

- Gilt Funds: Invest in government securities with low credit risk.

- Corporate Bond Funds: Invest in corporate bonds with varying credit ratings.

- Liquid Funds: Invest in short-term money market instruments with high liquidity.

- Fixed Maturity Plans (FMPs): Invest in debt instruments with a fixed maturity date.

-

3. Hybrid Funds:

- Investment Focus: Invest in a mix of equity and debt securities.

- Objective: A balance between growth and income.

- Risk Level: Moderate risk, depending on the allocation between equity and debt.

-

Types of Hybrid Funds:

- Balanced Funds: Maintain a fixed allocation between equity and debt (e.g., 60% equity, 40% debt).

- Asset Allocation Funds: Dynamically adjust the allocation between equity and debt based on market conditions.

- Aggressive Hybrid Funds: Have a higher allocation to equity (e.g., 70-80% equity).

- Conservative Hybrid Funds: Have a lower allocation to equity (e.g., 20-30% equity).

-

4. Solution-Oriented Funds:

- Investment Focus: Designed to help investors achieve specific financial goals.

- Objective: Goal-based investing.

-

Types of Solution-Oriented Funds:

- Retirement Funds: Help investors save for retirement.

- Children's Funds: Help investors save for their children's education or other needs.

-

5. Other Funds:

- Index Funds: Track a specific market index.

- Exchange-Traded Funds (ETFs): Trade on a stock exchange like individual stocks.

- Fund of Funds (FoFs): Invest in other mutual funds.

- International Funds: Invest in stocks or bonds of foreign companies.

- Commodity Funds: Invest in commodities, such as gold, silver, or oil.

3. Advantages of Investing Through Mutual Funds

- Diversification: Reduces risk by spreading investments across a wide range of securities.

- Professional Management: Access to the expertise and experience of professional fund managers.

- Liquidity: Easy to buy and sell shares or units of the fund.

- Convenience: Simplified investment process with easy access and management.

- Accessibility: Lower minimum investment amounts compared to direct investment in individual securities.

- Transparency: Regular disclosure of fund holdings and performance.

- Regulation: Mutual funds are regulated by government agencies to protect investors.

- Economies of Scale: Lower transaction costs and access to investment opportunities that may not be available to individual investors.

4. Disadvantages of Investing Through Mutual Funds

- Fees and Expenses: Mutual funds charge fees and expenses, such as expense ratios, which can reduce returns.

- Lack of Control: Investors have no direct control over the fund's investment decisions.

- Market Risk: Mutual funds are subject to the same market risks as the underlying securities.

- Potential for Underperformance: There is no guarantee that a mutual fund will outperform its benchmark index.

- Tax Implications: Capital gains distributions from mutual funds can be taxable.

- Administrative Burden: Regular paperwork and statements.

Conclusion:

Mutual funds provide a convenient and accessible way for investors to diversify their portfolios and benefit from professional management. However, it's important to carefully consider the fees, risks, and other factors before investing in a mutual fund. Understanding the different types of mutual fund schemes and their investment objectives is crucial for making informed investment decisions.

No Comments