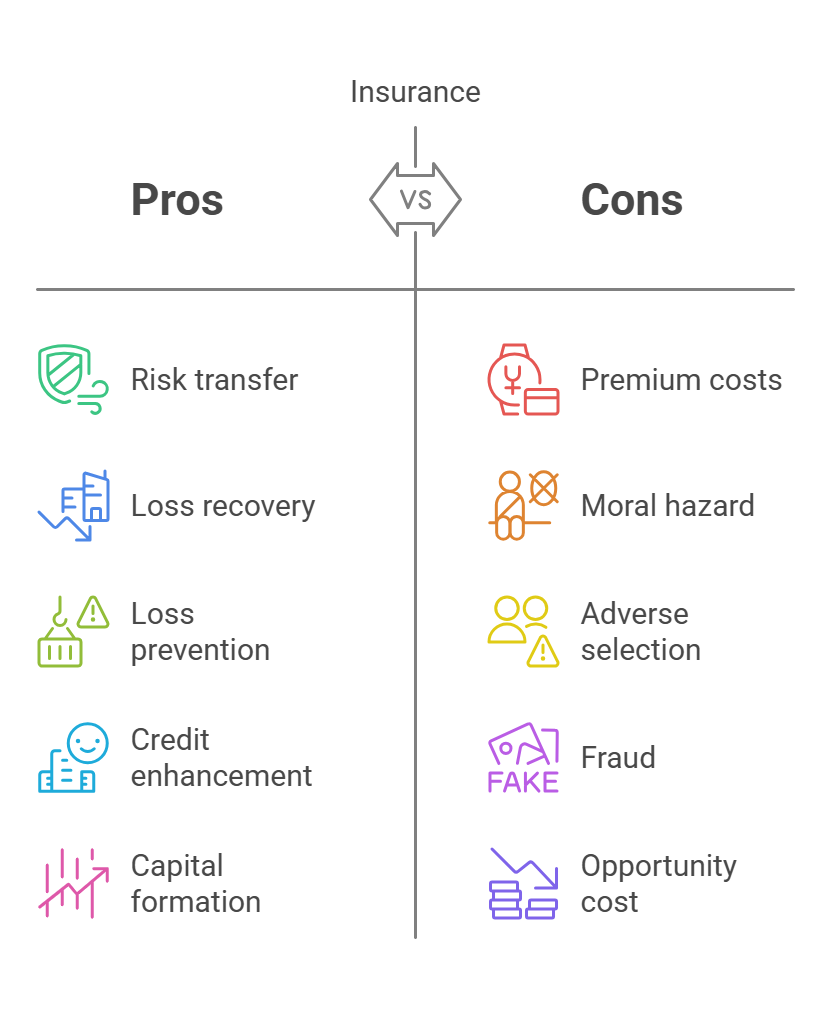

Benefits and Costs of Insurance to Society

Insurance plays a significant role in modern society, providing numerous benefits but also incurring certain costs. Understanding these benefits and costs is crucial for evaluating the overall impact of insurance on society.

I. Benefits of Insurance to Society:

-

A. Risk Transfer and Reduction:

- Explanation: Insurance allows individuals and businesses to transfer the financial risk of potential losses to insurance companies. This reduces the uncertainty and anxiety associated with those risks, allowing individuals and businesses to make decisions with greater confidence.

- Impact: Encourages entrepreneurship, investment, and economic activity.

-

B. Indemnification and Loss Recovery:

- Explanation: Insurance provides financial compensation to individuals and businesses who experience covered losses. This indemnification helps them recover from those losses and continue their activities.

- Impact: Minimizes the financial impact of accidents, disasters, and other adverse events, helping individuals and businesses rebuild and recover.

-

C. Loss Prevention and Risk Control:

- Explanation: Insurance companies often provide incentives for policyholders to implement loss prevention and risk control measures. They may offer lower premiums to those who take steps to reduce their risk of loss.

- Impact: Reduces the frequency and severity of accidents and other adverse events, benefiting both the insured and society as a whole.

-

D. Credit Enhancement:

- Explanation: Insurance can enhance creditworthiness by providing assurance to lenders that borrowers will be able to repay their debts even if they experience a loss. For example, a business with property insurance may be more likely to obtain a loan than one without insurance.

- Impact: Facilitates access to credit for individuals and businesses, promoting economic growth.

-

E. Investment and Capital Formation:

- Explanation: Insurance companies collect premiums from policyholders and invest those funds in financial markets. This investment contributes to capital formation and economic growth.

- Impact: Provides a source of capital for businesses and governments, supporting infrastructure development, job creation, and other economic activities.

-

F. Social Safety Net:

- Explanation: Insurance provides a social safety net by providing financial protection to individuals and families who experience unexpected losses. This helps to prevent poverty and reduce reliance on government assistance.

- Impact: Contributes to social stability and reduces the burden on taxpayers.

II. Costs of Insurance to Society:

III. Net Impact:

The net impact of insurance on society is generally positive, as the benefits of risk transfer, indemnification, loss prevention, and credit enhancement outweigh the costs of premiums, administrative expenses, moral hazard, and adverse selection. However, it is important to be aware of the costs of insurance and to take steps to mitigate them. This can be achieved through effective regulation, risk management, and consumer education.

No Comments