Chance of Loss

The "chance of loss" is a fundamental way to define risk, especially in the context of investment decisions. It directly addresses the probability of an investment resulting in a negative outcome, specifically a financial loss.

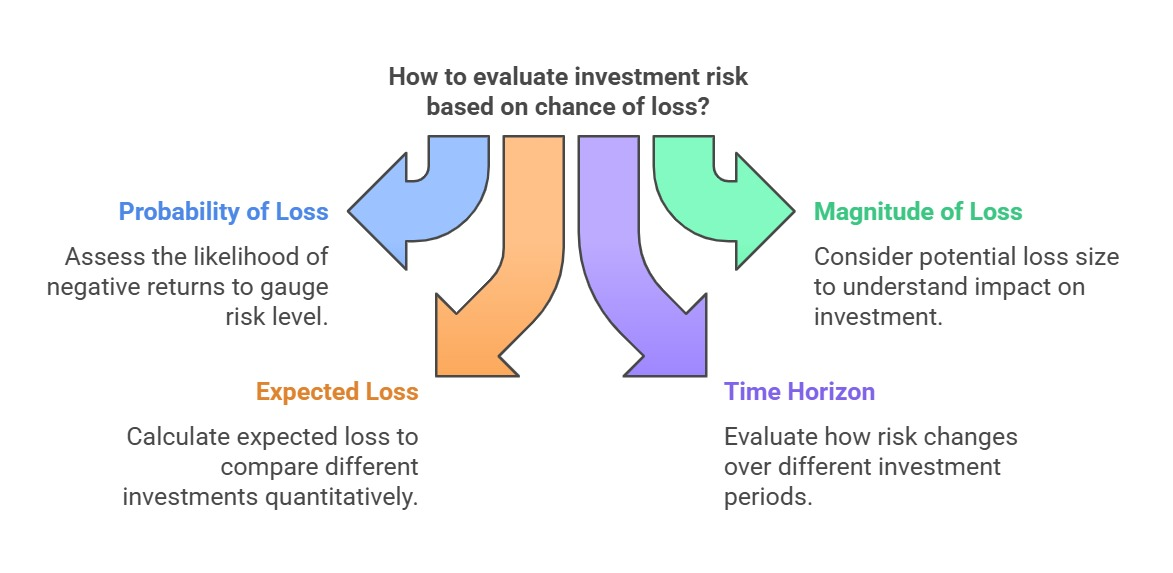

Key Components:

-

Probability of Loss: This refers to the likelihood that an investment's return will be negative, meaning you'll receive less money back than you initially invested. It's expressed as a percentage or a probability value (between 0 and 1).

-

Magnitude of Loss: This refers to the potential size of the loss. A high chance of a small loss might be considered less risky than a low chance of a very large loss.

-

Expected Loss: Calculated by multiplying the probability of loss by the potential magnitude of the loss. (Expected Loss = Probability of Loss * Magnitude of Loss). This gives a weighted average of potential losses.

Why "Chance of Loss" is Important:

Why "Chance of Loss" is Important: -

Investor Focus: Most investors are primarily concerned with avoiding losses. The "chance of loss" definition aligns with this concern.

-

Risk Aversion: Investors are generally risk-averse, meaning they dislike losses more than they like equivalent gains. The "chance of loss" highlights the potential for these disliked outcomes.

-

Decision-Making: Understanding the chance of loss allows investors to compare different investment opportunities and choose those that align with their risk tolerance.

Considerations:

-

Time Horizon: The chance of loss can change over different time periods. A short-term investment might have a higher chance of loss than a long-term investment in the same asset.

-

Inflation: When considering the chance of loss, it's important to account for inflation. Losing purchasing power due to inflation is also a form of loss.

-

Real vs. Nominal Loss: A nominal loss is a loss in the face value of the investment. A real loss is a loss after accounting for inflation. Investors are usually more concerned with real losses.

Example:

Imagine two investments:

- Investment A: Has a 10% chance of losing 20% of its value. Expected loss: 0.10 * 0.20 = 0.02 (2%)

- Investment B: Has a 5% chance of losing 40% of its value. Expected loss: 0.05 * 0.40 = 0.02 (2%)

Both investments have the same expected loss, but Investment B might be considered riskier because the potential magnitude of the loss is greater, even though the probability is lower. An extremely risk-averse investor might prefer investment A.

No Comments