Reinsurance – Definitions, Reasons for Reinsurance

Reinsurance is a critical component of insurance company operations, serving as a way for insurers to manage their risk exposure and enhance their financial stability.

I. Definitions of Reinsurance:

-

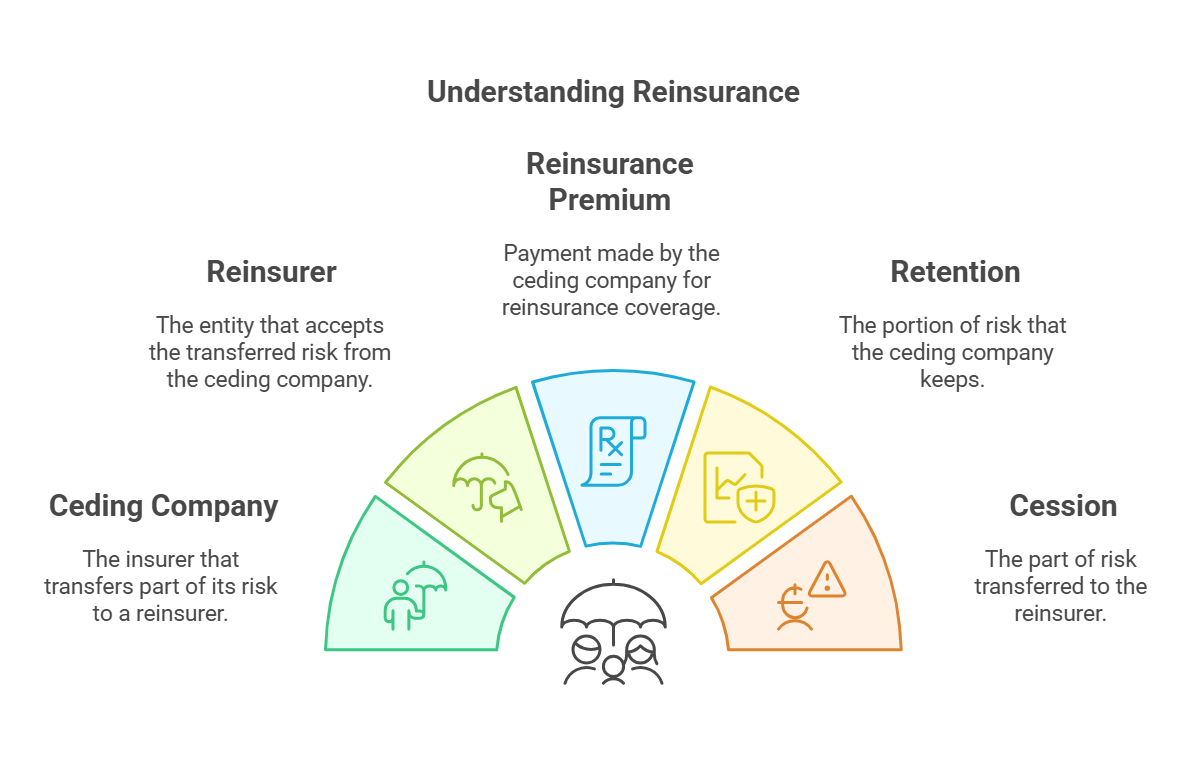

A. Basic Definition:

- Description: Reinsurance is insurance for insurance companies. It is the transfer of risk from one insurer (the ceding company) to another insurer (the reinsurer).

- Purpose: To protect the ceding company against large losses, to stabilize its financial results, and to increase its capacity to write new business.

-

B. Ceding Company (Primary Insurer):

- Description: The insurer that purchases reinsurance.

- Role: Retains a portion of the risk and transfers the remainder to the reinsurer.

-

C. Reinsurer:

- Description: The insurer that accepts the transferred risk from the ceding company.

- Role: Agrees to pay a portion of the ceding company's losses in exchange for a premium.

-

D. Reinsurance Premium:

- Description: The payment made by the ceding company to the reinsurer for the reinsurance coverage.

-

E. Retention:

- Description: The portion of the risk that the ceding company retains for its own account.

-

F. Cession:

- Description: The portion of the risk that the ceding company transfers to the reinsurer.

II. Reasons for Reinsurance:

-

A. Increase Underwriting Capacity:

- Explanation: Reinsurance allows a ceding company to write larger policies or a greater number of policies than it could otherwise support with its own capital and surplus.

- Benefit: Enables insurers to accept risks they would normally have to decline, expanding their market reach.

-

B. Stabilize Profits:

- Explanation: Reinsurance helps to smooth out fluctuations in the ceding company's financial results by protecting it against large or unexpected losses.

- Benefit: Reduces the impact of catastrophic events on the insurer's profitability, providing greater financial stability.

-

C. Protection Against Catastrophic Losses:

- Explanation: Reinsurance provides protection against catastrophic events, such as hurricanes, earthquakes, or large-scale liability claims.

- Benefit: Ensures the ceding company can meet its obligations to policyholders even in the event of a major disaster.

-

D. Transfer of Underwriting Expertise:

- Explanation: Reinsurers often have specialized expertise in certain lines of business or types of risk.

- Benefit: Ceding companies can benefit from the reinsurer's knowledge and experience.

-

E. Financing:

- Explanation: Reinsurance can provide a form of financing for the ceding company, allowing it to free up capital for other purposes.

- Benefit: Improves the ceding company's financial flexibility.

-

F. Compliance with Regulatory Requirements:

- Explanation: Regulators often require insurers to maintain a certain level of surplus to protect policyholders. Reinsurance can help insurers meet these requirements.

- Benefit: Ensures the ceding company meets regulatory solvency requirements.

-

G. Spread Risk:

- Explanation: By sharing risk with a reinsurer, primary insurers can diversify their risk portfolio and reduce the impact of any single event.

- Benefit: Improves the overall stability of the insurance company.

-

H. Legacy Risk Transfer:

- Explanation: Reinsurance can be used to transfer the risk of existing liabilities from past underwriting decisions.

-

Benefit: Allows insurers to exit lines of business or geographic areas and reduce exposure to legacy risks.

In summary, reinsurance is a valuable tool for insurance companies, providing them with financial protection, increasing their underwriting capacity, and helping them manage their risk exposure. It is an essential component of a well-functioning insurance market.

In summary, reinsurance is a valuable tool for insurance companies, providing them with financial protection, increasing their underwriting capacity, and helping them manage their risk exposure. It is an essential component of a well-functioning insurance market.

No Comments